Part 2 of this series looks more closely at several specific benefit offerings and the important guaranteed issue feature.

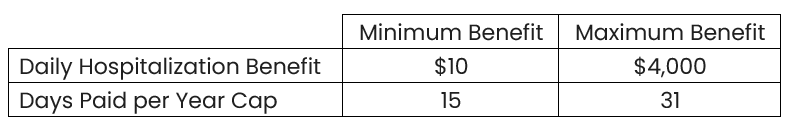

Hospitalization Benefits

All senior-focused HI products offer a “per-admission” hospitalization benefit in addition to a daily hospitalization benefit. Filed daily benefit ranges are shown here:

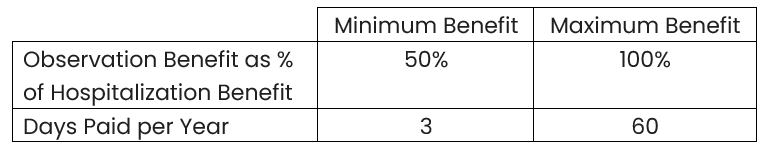

Observation Stay Benefits

In cases where a policyholder spends time in an “observation” room at a hospital and is not necessarily admitted as an inpatient, confusion is a common result. From the policyholder’s perspective, they were hospitalized, even if the hospital and the insurance policy do not consider them admitted. Senior-focused HI policies offer an observation stay benefit, sometimes paid at the same level as the hospitalization benefit, sometimes at a reduced rate.

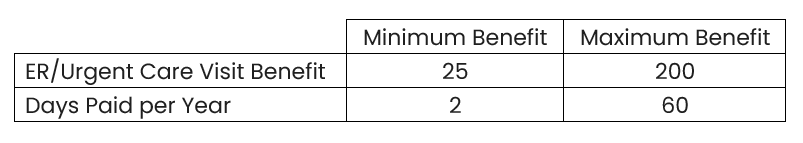

Emergency Room and/or Urgent Care Benefit

Visits to an Emergency Room or Urgent Care center can be very costly, a fact well-known to insurers. A simple indemnity benefit for a visit to one of these locations is nearly always provided. Most policies will pay this benefit even if the policyholder is not ultimately admitted to a hospital, though there are exceptions.

Cancer Benefit Option

Most plans offer an optional cancer benefit rider, paying a lump-sum benefit upon diagnosis of internal cancer.

Numerous benefit variations can be built, with several to note listed here:

-

Some pay a reduced benefit for diagnosis of skin cancer or carcinoma in-situ.

-

Some will only pay for a first diagnosis of cancer; if a specific cancer has been diagnosed in the past it may not qualify for benefit payment.

-

A recurrence benefit is sometimes provided, where the policyholder is eligible for benefit payment upon a repeated diagnosis. Often the specific cancer must have been in remission for a specified period of time before eligible for this benefit.

Guaranteed Issue Availability

Hospital Indemnity coverage is often purchased alongside a Medicare Advantage product, which does not require underwriting to obtain coverage. It can seem unwieldly to require underwriting and a “higher bar” for issuing the ancillary product when that is not required for the primary coverage. Allowing easier access to supplemental coverage for a spouse who may not be the same age is another reason carriers consider guaranteed issue ranges.

Most carriers will issue their HI products to applicants within a specific range of ages without requiring underwriting. This range typically starts at age 64 or 64½. The upper end of this range varies more by carrier, averaging 71 for a set of common plans.